Featured

Table of Contents

- – How "Debt Forgiveness Is a Failure" Debunked c...

- – The Ultimate Guide To Everything Must Prepare ...

- – Getting My Community-Based Managing Money Dur...

- – The smart Trick of Credentials to Look For fr...

- – Little Known Questions About Maintaining a S...

- – Indicators on The Advantages and Disadvantag...

Using for credit report card financial obligation mercy is not as straightforward as requesting your equilibrium be erased. Financial institutions do not easily use debt forgiveness, so understanding just how to provide your instance effectively can boost your possibilities.

I wish to discuss any alternatives offered for lowering or resolving my financial obligation." Financial obligation mercy is not an automated alternative; oftentimes, you need to negotiate with your financial institutions to have a part of your equilibrium lowered. Credit rating card firms are usually open up to settlements or partial mercy if they think it is their ideal opportunity to recoup several of the cash owed.

How "Debt Forgiveness Is a Failure" Debunked can Save You Time, Stress, and Money.

If they offer full forgiveness, get the arrangement in composing before you approve. You could require to send a formal written demand clarifying your difficulty and exactly how much forgiveness you require and provide documentation (see next section). To bargain properly, try to understand the lenders placement and use that to provide a solid instance regarding why they ought to deal with you.

Below are the most usual mistakes to prevent at the same time: Creditors will not just take your word for it. They require proof of economic challenge. Always guarantee you receive verification of any kind of mercy, settlement, or hardship plan in composing. Lenders might supply less alleviation than you require. Bargain for the very best possible terms.

The longer you wait, the extra charges and rate of interest accumulate, making it more challenging to qualify. Financial debt mercy includes lawful considerations that consumers need to understand prior to continuing. Customer security regulations govern exactly how lenders deal with mercy and negotiation. The following federal regulations help safeguard customers looking for debt mercy: Bans harassment and violent debt collection methods.

The Ultimate Guide To Everything Must Prepare For In the Bankruptcy Process

Calls for lenders to. Forbids debt negotiation firms from charging upfront fees. Comprehending these securities helps avoid frauds and unreasonable creditor practices.

Making a payment or also acknowledging the financial debt can restart this clock. Also if a lender "charges off" or writes off a financial debt, it doesn't imply the financial obligation is forgiven.

Getting My Community-Based Managing Money During a Long Illness: Working with Creditors Before Bills Pile Up Organizations Explained To Work

Before consenting to any type of layaway plan, it's a good idea to check the statute of constraints in your state. Legal effects of having financial debt forgivenWhile debt forgiveness can eliminate financial worry, it includes possible legal effects: The internal revenue service treats forgiven financial debt over $600 as gross income. Debtors get a 1099-C kind and must report the quantity when filing tax obligations.

Right here are a few of the exemptions and exceptions: If you were bankrupt (suggesting your overall financial obligations were more than your overall properties) at the time of forgiveness, you may omit some or all of the canceled financial debt from your gross income. You will require to fill in Form 982 and connect it to your income tax return.

While not connected to charge card, some pupil funding mercy programs allow debts to be canceled without tax obligation repercussions. If the forgiven financial obligation was connected to a qualified farm or service procedure, there might be tax exclusions. If you don't get approved for financial debt mercy, there are different financial debt relief techniques that may function for your scenario.

The smart Trick of Credentials to Look For from Other Debt Relief Companies That Nobody is Talking About

You make an application for a brand-new lending big sufficient to repay all your existing credit card equilibriums. If approved, you utilize the new finance to repay your credit rating cards, leaving you with just one regular monthly repayment on the consolidation car loan. This simplifies financial obligation administration and can conserve you cash on rate of interest.

Most importantly, the company discusses with your financial institutions to lower your rate of interest rates, dramatically reducing your general debt concern. DMPs may also decrease or eliminate late fees and penalties. They are a fantastic debt solution for those with poor debt. When all other choices fail, insolvency might be a viable course to removing frustrating bank card financial obligation.

Allow's face it, after several years of higher costs, cash doesn't reach it utilized to. About 67% of Americans say they're living income to income, according to a 2025 PNC Financial institution research, which makes it difficult to pay for financial obligation. That's specifically true if you're bring a huge financial obligation equilibrium.

Little Known Questions About Maintaining a Sustainable Spending Strategy That Lasts.

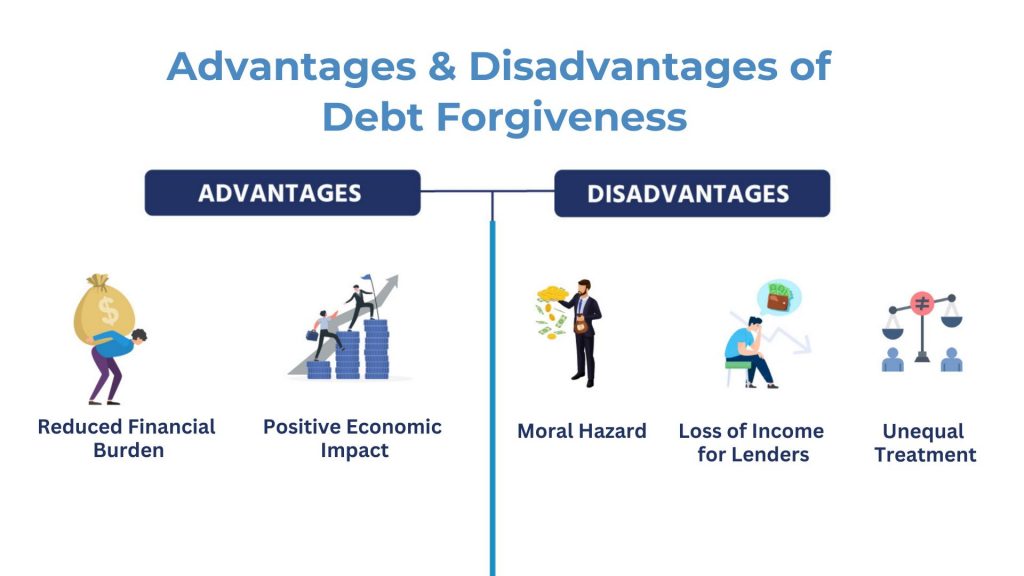

Loan consolidation fundings, financial debt management strategies and settlement techniques are some approaches you can make use of to minimize your debt. If you're experiencing a major financial challenge and you've exhausted various other alternatives, you might take an appearance at financial debt forgiveness. Financial obligation mercy is when a lending institution forgives all or several of your impressive balance on a finance or various other charge account to assist ease your debt.

Debt forgiveness is when a lending institution agrees to clean out some or all of your account equilibrium. It's a strategy some individuals utilize to lower financial debts such as credit report cards, individual lendings and student finances.

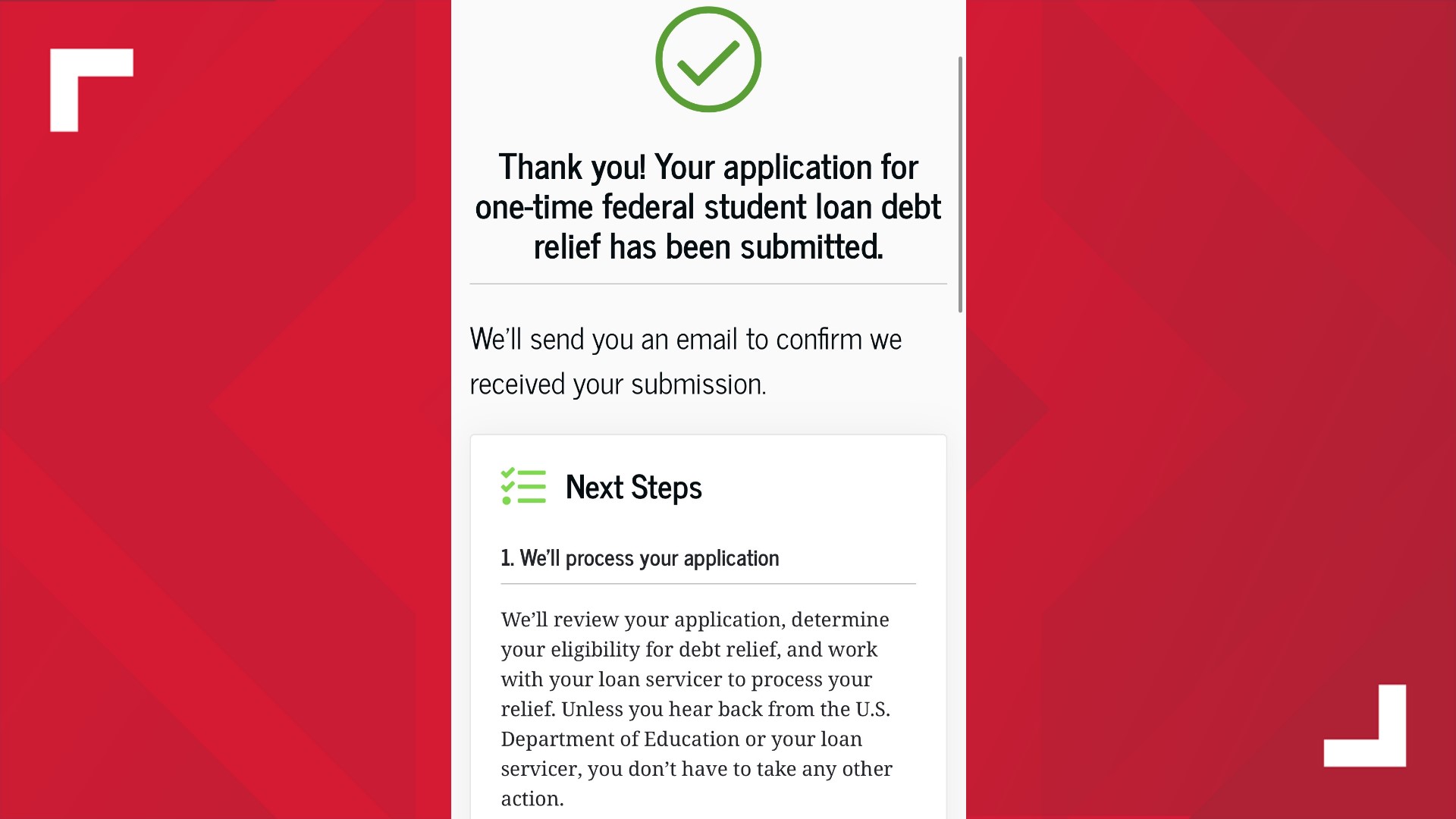

The most widely known option is Public Solution Car Loan Forgiveness (PSLF), which cleans out remaining federal loan equilibriums after you function complete time for a qualified company and make payments for 10 years.

Indicators on The Advantages and Disadvantages of Bankruptcy You Should Know

That implies any type of nonprofit healthcare facility you owe may have the ability to offer you with financial debt alleviation. Majority of all united state health centers supply some type of medical financial obligation relief, according to client solutions advocate team Dollar For, not simply nonprofit ones. These programs, often called charity treatment, minimize or perhaps get rid of clinical costs for competent people.

Table of Contents

- – How "Debt Forgiveness Is a Failure" Debunked c...

- – The Ultimate Guide To Everything Must Prepare ...

- – Getting My Community-Based Managing Money Dur...

- – The smart Trick of Credentials to Look For fr...

- – Little Known Questions About Maintaining a S...

- – Indicators on The Advantages and Disadvantag...

Latest Posts

What Does Government Initiatives That Offer Debt Relief Mean?

The 6-Second Trick For Actions to Take Once Bankruptcy

Unknown Facts About What the Law Says When Undergoing Debt Relief Options for Travel Nurses and Contract RNs

More

Latest Posts

What Does Government Initiatives That Offer Debt Relief Mean?

The 6-Second Trick For Actions to Take Once Bankruptcy

Unknown Facts About What the Law Says When Undergoing Debt Relief Options for Travel Nurses and Contract RNs